I’ve realized that when I say I teach stock trading, people often assume that I’m talking about day trading. I have three types of trades that I teach: Swing Trading, Chart Trading, and Day Trading. What I mainly teach and where I make most of my money from is swing trading, and there are many important differences between these trading types. I’ve outlined the major ones here to clear up the confusion:

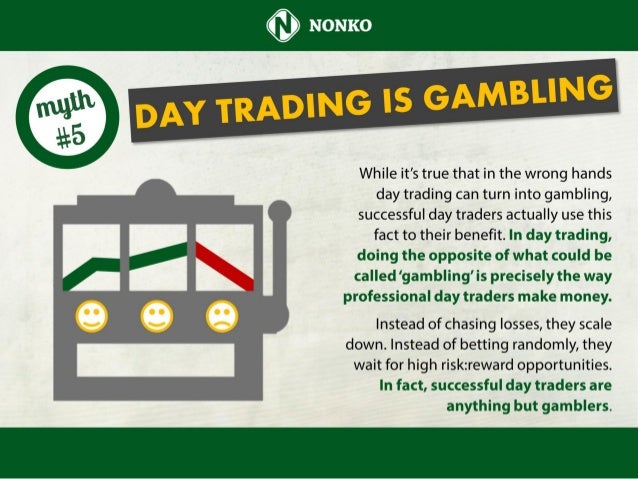

Dec 21, 2018 Murray says for most investors, there's no difference between day trading strategies and gambling at a casino. He also says bull markets tend to make day traders look more skilled than they.

Risk

Day trading can put you into debt — fast. Day traders generally use margin (borrowed money), so while this gives them more money and thus more potential to make profit, they can also lose much more. When you lose at day trading on margin, you lose big time. Stocks can move fast and the inexperienced can lose money fast. The big mistake is most new traders jump into day trading with little knowledge and that essentially equates to gambling.

Swing trading doesn’t rely so heavily on margin (you don’t have to use it if you don’t want to), so you don’t have to worry about winding up in debt. That doesn’t mean swing trading is risk free (far from it), but there are relatively less opportunities to lose money based on the risk management rules I teach.

Time Commitment

Day trading requires a huge time commitment, much more so than swing trading. Since day traders change positions at such small intervals (1-minute, 3-minute, 15-minute, etc.) they have to constantly monitor their positions to make sure they’re still in a profitable place. This can lead to serious personal stress over time. A lot of people that day trade do so as a full time job, either as part of a corporate institution or independently.

Swing trading uses time frames that are much longer (you generally hold your securities for several days/weeks). You still have to make sure that you’re in a favorable position, but you have some breathing room. It’s entirely possible to profit from swing trading on a part-time basis while holding down a full time job in something else. This flexibility makes it a great option for people who want to learn how to trade profitably without devoting their entire lives to it.

Startup Cost

How To Be A Day Trader

Day traders compete with hedge funds, high-frequency traders, and other market professionals whose entire businesses revolve around having trading advantages. If you’re an individual hoping to compete with these institutions, you’re going to have to obtain state-of-the-art trading software, a trading platform, and other cutting edge technology.

Meanwhile, swing trading can be done on an individual basis for relatively little startup money. A standard computer/laptop and conventional trading tools are all you need to begin swing trading. There are many free sites where research can be done. I teach all of this to my students.

Stress

Investing Vs Gambling

As you can probably tell by this point, day trading is highly stressful. You are essentially monitoring your positions on a minute-to-minute basis. You must be disciplined, decisive, and have more than a cursory understanding of the markets. After all, you’re going up against corporate finance professionals who make their livings off of this.

The general strategy used in swing trading makes it so that with some studying, even people who know nothing about finance can become successful. Don’t misunderstand, it’s not necessarily “easier,” and there are definitely pitfalls to trading in general. However, if you’re not ready to commit to trading full time, swing trading is generally the better and less riskier option.

Virtual Day Trading

What Is Day Trading Stocks

I hope this has cleared up the confusion. I mainly teach my students how to make profitable swing trading decisions. For those of you who are interested in trading but don’t have a strong background in finance and work a full time job, your best bet is swing trading.